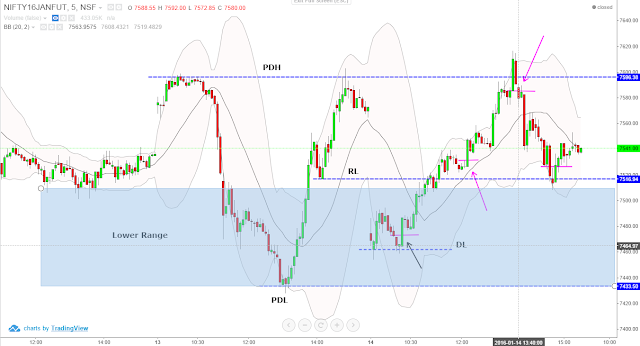

One Chart posted by one of the readers - Danish.. LT & other one is example purposefully taken by me..Maruti..

LT - 15 min of 5th Jan'16 : Downtrend with squeeze formation. 1st Tag on LBB + DP. 2nd Touch on UBB + DP. Setup is Formed.

Entry on break of Green Candle Low marked with Pink Line .. SL above recent high :)

MARUTI Daily Chart:

MARUTI Daily Chart: One of the Biggest task in Trading is to ANTICIPATE the moves. if the anticipation is done right as per bias, half of the Job is done. A setup must be known to you beforehand like 5 ~ 10 candles before. Shortlist those charts & get ready for a Sniper entry..

Below is the chart of Maruti. A Good Setup is in formation. Bias is clearly UP. Squeeze has already started from (B). Now a tag should come at (1) and finally at (2). We will look to ride the Trend from (2) on high of a Red Candle.

This chart is till Yesterday. Maruti has given a big Red candle today on Daily chart. If it doesn't go to (1), simply move on to next chart.

If someone wants to go long at (B) position assuming (A) as tag of UBB + DP, that is also fine. Its a Good Setup, but not a Strong one as BB are not properly Flat.

Will Post Few more examples day by day with some Trade opportunities..